Sustainable Leadership in Europe Report published

CEC European Managers has published a new report on the state of Sustainable Leadership in Europe. The representative findings, based on a survey among 1500 managers from six EU countries, highlight a clear gap between the political ambition of transitioning to a greener and fairer future and the management reality on the ground. While many managers are convinced of the importance of sustainability, it is insufficiently put in practice in companies. The lacking implementation of sustainability measures may be linked to traditional leadership values, inadequate education and training of managers, as well as regulatory pitfalls.

The current global recession, climate emergency and socio-economic polarisation are a wake-up call. The findings of the « Sustainable Leadership in Europe » report clearly show that managers are aware of the importance and value of sustainability. However, the complex and interrelated challenges are too often not in line with the skills of the people who have to deal with them. Without skilled and committed managers, the required changes towards an economy in line with societal needs and planetary boundaries are likely to fail. The current narrative around the transition too often ignores the human side of things.

“The current challenges, especially the economic crisis, are complex to resolve. Fortunately, our “Sustainable Leadership in Europe” report clearly highlights how to overcome a major obstacle to building a more resilient and sustainable economy. Managers need a European scheme equipping them with the right skills and knowledge needed in this transformation.”

– Ludger Ramme, President of CEC European Managers

It’s now about putting Sustainable Leadership into practice, by targeting those who are responsible for shaping the future of their companies. That’s why the project partners of the “Sustainable Leadership Project”, led by CEC European Managers, are developing an evidence-based European Pilot Training Programme for European managers on Sustainable Leadership. The innovative training will allow providing relevant knowledge, skills and resources for the change-makers of the future.

The « Sustainable Leadership in Europe » research, conducted by Professor Alberto Pastore and his team, introduces a new model of Sustainable Leadership. The reality on the ground, as revealed by the study, shows that ambition and capabilities are in mismatch. Its representative survey among more than 1500 managers in six European countries[1] shows the main areas in which managers need to improve.

The “Sustainable Leadeship in Europe” report gives relevant information about the state of Sustainability in European management.

When it comes to knowledge, many respondents are not aware of key political frameworks and legislation, such as the non-financial reporting directive. As far as values are concerned, only around 40% share values associated with sustainability. The education of managers, but also office culture, can be factors of explanation.. Only few managers are aware on what sustainability indicators are relevant to their organisation, left alone implementing an accurate materiality assessment.

Despite these challenges, the research also highlights that the topic of sustainability has clearly entered the mainstream. There is broad consensus on the importance of sustainability in general and associated indicators, such as respect for human rights or waste reduction, in particular. The comparison between the general managerial population and managers affiliated to CEC European Managers has highlighted how the latter generally score better on Sustainable Leadership, especially in the area of soft skills. A larger involvement of managers in social dialogue and professional associations could thus contribute to improve sustainability performance.

Lastly, the results of the survey can also be seen as an opportunity to put the upskilling of managers on top of political priorities. After the publication of the studies, the project will continue with a series of webinars and seminars, organised for managers from across Europe. Stay tuned!

Visit SustainableLeaders.eu!

Check out the Sustainable Leadership in Europe – Executive Summary

Please find the Press Release here.

[1] Germany, France, Italy, Spain, Poland and Denmark

Sustainability measurement and reporting in Europe

To be able to change a company’s or organisation’s performance in the economic, governance, social and environmental dimensions of sustainability, it is important to understand how sustainability is being measured and reported. Managers need to understand the different sustainability indicators, covered by frameworks as described below, be able to measure the right and relevant things and then report on the sustainability impacts in a transparent and integrated way. This article is an extract from the “Sustainable Leadership in Europe” report.

Identifying sustainability risk increasingly becomes a competitive advantage. Only few companies are describing these risks in their reports, as the results of the Alliance for Corporate Transparency analysis of implementation of the EU Non-Financial Reporting Directive shows.

Sustainability Reporting is often characterised by the use of several acronyms such as “Non-Financial information Reporting (NFR)”, “Corporate Social Responsibility (CSR) Reporting”, “Environment, Social and Governance (ESG) Reporting”, “Extended external Reporting (EER)”, or “Integrated Reporting (IR)”.

In order to introduce the idea of Sustainability Reporting we refer to the definition given by the European Court of Auditors, European Union (2019)[1]: “Sustainability Reporting is the practice of measuring, disclosing and being accountable to internal and external stakeholders for Organisational performance towards the goal of sustainable development. It involves reporting on how an Organisation considers Sustainability issues while running its operations, and on its environmental, social and economic impacts. A Sustainability Report also presents the Organisation’s values and governance model and demonstrates the link between its strategy and its commitment to a sustainable global economy“.

It is crucial to highlight that a Sustainability Report is the product of a process.

The prerequisites to be focused for meaningful Sustainability reporting are:

- Stakeholders’ involvement

- Analysis of what Sustainability elements are material/matters

- Identification of Sustainability risks & opportunities

- Development of a Sustainability strategy

- Setting of managerial Sustainability objectives

- Integration of Sustainability into the budget process based on objectives measured by indicators

- Sustainability performance measurement and reporting

Although recent norms have expanded both the spread of the reporting process and the adoption of homogeneous of methodological disclosure criteria, Sustainability reporting can manifest itself in many heterogeneous ways, both for processes and for disclosure methodologies adopted. The solutions do range from narrow environment-focused reporting to reports analysing the effects on the whole stakeholder system (Environmental, Social, Economic, Governance), as well as modules contemplating Sustainability strategies integrated into corporate business models.

The number of businesses reporting on the ESG impacts has exponentially grown throughout the last 25 years. At the same time, investors have increasingly grown interest in ESG data. For instance, the Social Responsible Investments, SRI sum up to 26% of the total investments (58% of which take place in Europe)[2].

In 2018, The European Commission published the EU Action Plan for Sustainable Finance in order to attract more private interests for sustainable activities and foster the integration of ESG criteria in the investments processes.

REFERENCE LEGISLATION: DIRECTIVE 2014/95/EU

Directive 2014/95 / EU has the objective to drive and lead the methods of publication of non-financial information by Companies, helping to spread transparency of non-financial performances by stakeholders, while strengthening trust between companies, citizens and public and financial institutions[3].

The following criteria define the “Public Interest Entities” which are bound to publish non-financial reporting:

- Average number of Employees superior to 500 throughout the financial year

- Exceeded at least one of the two limits by the balance sheet closing date:

- A balance sheet total of at least 20 million Euros

- Total Net Revenue from products and/or services sales equivalent to at least 40 million Euro.

In terms of content required, these entities are required to provide a non-financial reporting containing “at least” environmental, social, personnel information, respect for human rights, the fight against corruption, to an extent necessary to understand the progress of the company, its results, its situation and the impact of its business and the main risks associated with social-environmental issues deriving from business activities.

In particular, this disclosure must contain, in addition to a brief description of the company business model, information on the policies applied by the Company regarding the above mentioned aspects and on the results achieved thanks to the implementation of these policies.

In the case the company does not adopt any policy, it is required to provide “A clear and detailed explanation” of this choice (“comply or explain”).

In terms of Report collocation, the NFR Directive provides an option for non-financial statements to be included in the annual report or in a stand-alone report, and it requires companies to specify which reporting frameworks they have relied on.

The main options found are:

- Separate reports

- Report included in the annual management report as a distinct section

- Report included in the financial statements file as a separate section

- Report included in the management report with references

The major disclosure areas concerning the reporting perimeter are:

- Impact evaluation & policies

- Risks evaluation

- Outcomes

- KPI’s

- Business model description.

With regards to the Reporting frameworks, the European Commission Guidelines clarify that the information contained in the non-financial declaration must be provided according to the methodologies and principles envisaged by the reporting standard chosen as reference

The “Reporting Standards” are “the standards and guidelines issued by authoritative supranational bodies, international or national, of public or private nature, functional, in whole or in part, to fulfil the non-financial reporting obligations in question”.

The organisations subject to this directive can rely on national, EU or international standards such as[4]:

- Global Reporting Initiative (GRI)

- United Nations Sustainable Development Goals (UN SDG’s)

- UN Global Compact (UNGC)

- United Nations Guiding Principles Reporting Framework (UNGP)

- ISO 26000

- CDP environmental reporting system and framework

- International Integrated Reporting Council (IIRC)

- Sustainability Accounting Standard Boards (SASB)

- OECD Guidelines/General or sectoral due diligence guidance

- Climate Disclosure Standards Board Framework

- International Labour Organisation standards

- European Commission Guidelines on Non-Financial Reporting

- ILO StandardsThe eco-management and audit system (EMAS)

- The OECD guidelines for multinational enterprises

- Other national or international recognised standards

Companies are anyway allowed to adopt independent reporting methodologies, but in this case, they are requested to provide “clear and detailed description of such methodology and the reasons for its adoption”.

GRI STANDARDS

The Global Reporting Initiative (GRI) is the most used reporting standard worldwide.

The Global Reporting Initiative GRI is a non-profit Organisation created with the aim of supporting both the public sector and the private sector in understanding, measuring and communicating the impact that any activity can have on the various dimensions of sustainability (economic, environmental and social).

GRI recently formulated the new version of its NFR Guidelines, giving life to the GRI Sustainability Reporting Standards (GRI Standards), which replaced the original GRI G4 Guidelines. The new guidelines are structured in a modular and interconnected system of standards characterized by flexibility and versatility, and therefore easily adaptable to the profile of companies. The new system defines on one hand the general standards (foundation, general disclosure standards and management approach) and on the other, three sets of specific standards dedicated to the three fundamental impact dimensions: Economic, Environmental, Social.

The general standards give the organisation a practical guide on how to structure its Sustainability report and what basic principles to follow, including the pivotal principle of materiality. By applying the principles and guidelines of the GRI 101, it is in fact possible to identify the specific aspects of its business that have the most significant impacts — positive and / or negative — both on business and on stakeholders. Starting from the results of the materiality analysis, the company will be able to select, among the set of specific standards, the most suitable ones to represent and measure the impacts identified as most relevant.

In parallel, two general standards must also be applied: the GRI 102 (General Disclosures) serves to report context information relating to the Organisation and its reporting practices, while the GRI 103 (Management Approach) explains how the relevant features are operationally managed by the Organisation.

Each standard follows a similar structure, based on “Reporting requirements”, “Recommendations” and “Guidance” aimed at facilitating the understanding of mandatory and optional information requirements.

In drafting its report, each company has the possibility to choose at what level to apply the GRI Standards, compared to three different solutions:

- GRI “in accordance Core“, in which the company has a set of mandatory profile information, as well as having to report at least one indicator for each material aspect;

- GRI “in accordance Comprehensive“: where the mandatory Organisational profile information is significantly higher, especially with respect to governance, and all the KPIs provided by the standard material results for the company, must be reported;

- GRI “referenced Claim“, introduced with the new standards, in which companies can select some specific set standards[5].

MATERIALITY ANALYSIS AND RELEVANT TOPICS

The legislation requires that companies follow a criterion of relevance — or “materiality” — to select the aspects that must be treated in the NFR.

Therefore, the description of the company’s activities, risks, policies and its socio-environmental impacts must concern those issues which, taking into account peculiarities of the company and the sector in which it operates, reflect more directly the economic impacts, environmental and social aspects of the organisation and the relationship with stakeholders.

This assessment is done through a materiality analysis, which consequently allows the company to identify which issues are to be considered priorities in relation to its business strategy and the stakeholder expectations. The information will have to focus on these issues, going to specify the objectives, management methods and results achieved.

The analysis ends with the definition of the Materiality Matrix, a matrix graphic representation that relates the assessment of relevance attributed to the various issues by the company (abscissa axis) and by stakeholders (ordered axis).

STRATEGIES, RISKS AND SUSTAINABILITY PLANS

The European Commission emphasizes that the management of Sustainability ought to be anchored to a clear long-term strategy, which finds its declination in an implementation plan which explains the priority areas, the lines of action, the qualitative and quantitative objectives. These elements must be formalised and publicly communicated.

Therefore, the NFR must include information relating to the strategy, the business model, the Sustainability objectives of the Company.

Furthermore, an important aspect connected to the NFR is the one related to Non-Financial Risks.

The European Directive, as well as the subsequent Decree 254, paid attention to disclosure on short, medium and long term non-financial risks, specifying that Companies should explain how the main risks can influence their business model, their operations, their financial results and the impact of their activities.

In recent years, Companies have invested significant resources in risk management models and Sustainability initiatives. Recently, under the pressure of a growing economic and reputational exposure to the risks associated with Environmental, Social and Governance factors, many Companies are working on the integration of the corporate processes that govern the management of business risks (“Enterprise Risk Management” or “ERM”) and Sustainability issues.

INSTITUTIONAL INVESTORS’ ATTENTION AND ESG RATING

The ability to manage ESG risks and opportunities has increasingly become a yardstick for assessing the solidity of Companies, as well as being a decision driver for investment choices. The analysis of the non-financial rating (ESG Rating) is therefore a structured tool that aims to provide detailed information for the improvement of investment choices and alongside the traditional financial rating.

The ESG rating is based on a process for interpreting Sustainability-related performance. That is, it depends on the assessment of the specific Sustainability risk scenario connected to the sector to which it belongs and to the specific company conditions and is therefore at the sole discretion of the ESG Rating Agency.

The lack of methodological and evaluation homogeneity can thus generate divergences in ESG ratings with reference to the same company.

ESG rating agencies use different methods and approaches when assessing environmental, social and governance aspects, and conceptualise ESG performance differently.

The main sources of divergence are scope divergence, weight divergence, measurement divergence[6].

The most important ESG Rating Agencies are:

- Climetrics (CDP – eg Carbon Disclosure Project)

- ECPI

- Morningstar

- MSCI

- Refinitiv

- S&P Global Ratings

- Vigeo Eiris

- ISS-Oekom

- Sustainalytics

FINAL CONSIDERATIONS

Taking note of the recent study The Alliance for Corporate Transparency Research Report[7] on the results generated by the European Union’s non-financial information directive, it can be said that the directive’s firm intention to link “policies, risks and results” is still far from being fully realized. Reporting practice is spreading, but there is a risk that Companies tend to report the policy and much less the results, the metrics and the interventions aligned with declared policy objectives.

Too many Companies still fail to set specific targets in line with the Paris Accord or the Sustainable Development Goals and measure their progress accordingly. Most Companies need to improve their reporting on targets on climate change, with specific risk mitigation strategies. And many Companies need to adequately address the supply chain. On social issues, Companies are seen too often conflating social goals with treatment of employees. And Governance is so often the one missed off the list as the NFR Directive does not explicitly require any specific governance-related disclosures.

Finally, the clarity of reporting is often affected by the lack of homogeneity in the frameworks used and in the presentation summary of the KPI’s.

REFERENCES

[1] European Court of Auditors – European Union, (2019).

[2] KPMG, (2019), Survey on Application of Italian Law nbr. 254/2016

[3] KPMG, (2019), Survey on Application of Italian Law nbr. 254/2016;

[4] Bold F., (2019) The Alliance for Corporate Transparency Research Report – An analysis of the Sustainability reports of 1000 Companies pursuant to the EU Non-Financial Reporting Directive, 2019.

[5] KPMG, (2019), Survey on Application of Italian Law nbr. 254/2016;

[6] Berg F., Koelbel J. F., Rigobon R., (2019), Aggregate Confusion: The Divergence of ESG Ratings, Management Sloan School.

[7] Bold F., (2019) The Alliance for Corporate Transparency Research Report – An analysis of the Sustainability reports of 1000 Companies pursuant to the EU Non-Financial Reporting Directive, 2019.

Managers need skills for greening jobs

The transition to a more inclusive and net zero economy requires people who can create value in line with societal needs and planetary boundaries. These “green jobs” do however not come from nowhere. As the “Sustainable Leadership in Europe” study shows, managers need to be equipped with “Green Skills for Greening the Jobs” skills.

The managerial evolution from a traditional leadership — business as usual leadership — to a Sustainable Leadership aiming at the Sustainable transformation of our economy, needs to overcome existing relevant gaps within the current managerial professional category. These gaps concerning the key Sustainability/green skills and competences necessary to the management of a phenomenon, are so vast and complex that it has effectively been renamed as the “Sustainability Elephant”.

Training requirements can be very broad in terms of different needs in terms of the geopolitical area, the industrial sectors and company reality, the organisational functions or managerial levels. It therefore makes sense to systematise the potential different areas of training requirements.

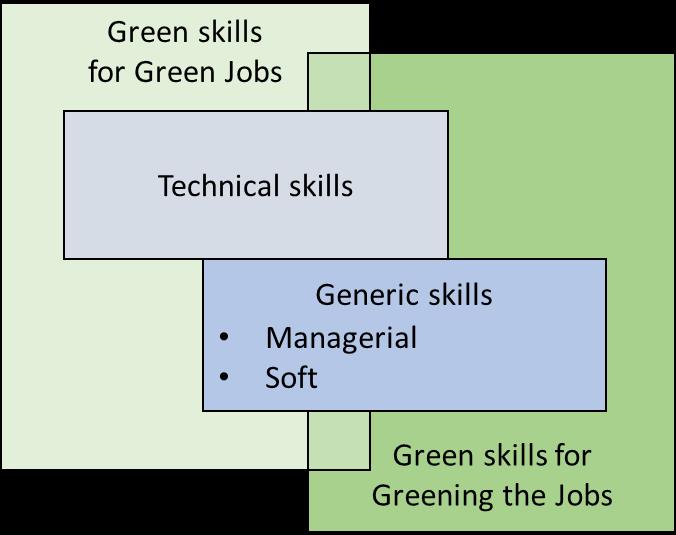

First, we shall properly distinguish between:

- Green skills for Green jobs: skills required for specific jobs as a response to the need for managerial transition, with roles such as “CSR manager”, “Sustainability Manager”, “Energy Manager”, etc.

- Green skills for Greening the Jobs: new skills for traditional managers with a view to shift traditional roles towards transition in order to play an active role in Sustainable Leadership

We then shall distinguish specific skills from generic skills:

- Technical (specific) skills: These skills are particularly relevant for the green economy, for it requires multidisciplinary approaches, including professionals from different backgrounds such as engineers, architects, ecologists and archaeologists. The specific skills are not completely new but rather the result of mixing pre-existing competences. There are several career opportunities of this kind within the Green Economy.

- Generic Skills: these skills can be divided into two categories. The first concerns the Generic Soft Skills, such as the relational and communication talents, and being able to work in groups. The second revolves around the Generic Managerial Skills, such as the strategic leadership, innovation skills, creativity and resource management. A good transversal comprehension of the technological and scientific topics is strongly suggested.

Since the Sustainability transformation affects all sectors and managerial position, it is of crucial importance to create a level playing field with regards to Generic Sustainable Skills, including managerial and soft skills.

Figure 2.5-7 Skills for Sustainable Leadership

Sustainable Leadership Guidelines

The Sustainable Leadership Guidelines provide innovative and practical advice to managers for transforming thought patterns, behaviours and processes in companies and beyond.

In many regards, our current way of producing, living and working has proven to be unsustainable. We have to change track and pursue a path in alignment to environmental, social and economic imperatives. Actors as diverse as policy-makers, businesses, managers and citizens have to contribute their fair share to attain the Sustainable Development Goals.

Since sustainable development consists of multiple dimensions and requires action at all levels, both political framework conditions and practices in organisations need to evolve. It’s about thinking both aspects together. There is urgency in shifting the current paradigm and reinvent the way we conceive both policies and the purpose of organisations in the light of the pressing environmental, but also social and economic challenges we are currently facing.

In fact, reorienting the purpose of organisations towards environmental and social objectives seems to also pay off economically. For instance, mounting evidence suggests[1] that firms investing in (material) sustainability tend to outperform other companies on traditional measures of performance. Despite that, only few companies have a unified sustainability strategy and even fewer have followed-up with actions, according to a McKinsey survey[2].

Against that background, the three intertwined dimensions of sustainable development [3] offer useful insights to businesses on what to change. They are helpful to understand the different impacts of production and consumption patterns. However, it is crucial to make sense of them at individual level: as a manager, as a worker or as a citizen. Furthermore, the question of “what impact” (on the environment etc.) is closely tied to the procedural “how” of achieving change (company structures and processes). For these reasons, personal and procedural sustainability add to the classical dimensions of economy, society and environment in the Sustainable Leadership Guidelines.

Discover how leadership can contribute to driving the sustainable shift and attain the Sustainable Development Goals in CEC European Managers’ Sustainable Leadership Guidelines (PDF).

[1] https://dash.harvard.edu/bitstream/handle/1/14369106/15-073.pdf?sequence=1

[2] www.mckinsey.com/business-functions/sustainability-and-resource-productivity/our-insights/sustainabilitys-strategic-worthmckinsey-global-survey-results

[3] Environment, society and economy